The increase in dog ownership over the pandemic has led to high demand for dog grooming services across the US, with mobile services becoming increasingly popular to accommodate busy schedules and anxious dogs. Spending on dog grooming services continue to increase, despite current economic uncertainties.

Market growth and spending growth

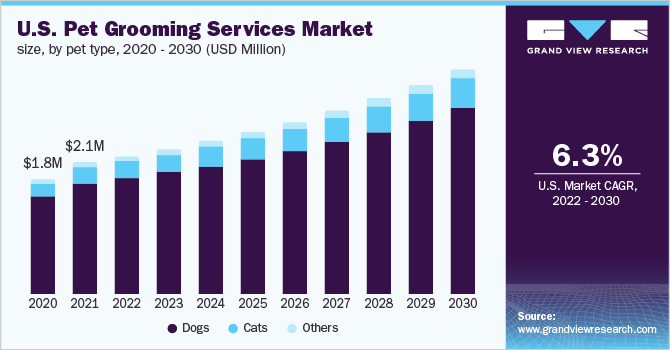

U.S. Pet Grooming Market Growth

*(1)

The pet grooming services market is predicted to grow at a rate of 6.3% annually between 2022-2030, indicating a positive outlook for this sector. It is expected to create more jobs in animal care and services.

The reasons for the growth in the North American market is down to:

- Increased pet ownership

- Increased awareness of the importance of keeping pets clean and healthy

- Increased popularity of mobile dog and cat grooming salons as a convenient choice for pet owners with limited time

- Increased spending on pet grooming and mobile services

With a growing pet industry and an increasing demand for professional grooming services, there is ample opportunity to start a successful dog grooming business.

*(2,3)

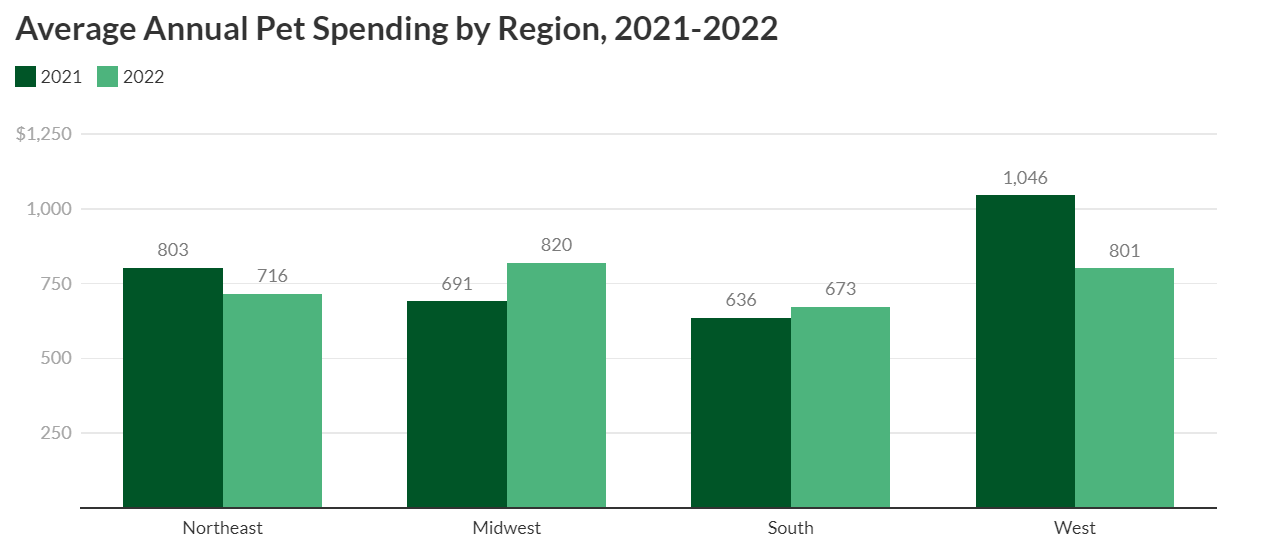

Average Pet Spending by Region

As economic uncertainty continues, the pet industry remains strong and resilient, with customers continuing to prioritise their pets’ health and happiness.

- According to the American Pet Products Association (APPA), Americans spent $136.8 billion on their pets in 2022, up from $123.6 billion in 2021. The APPA expects pet spending to keep its year-over-year increase, projected to hit $143.6 billion in 2023.

- Services such as grooming, dog walking and boarding totalled $11.4 billion spent in 2022, which is a 20% increase from the previous year.

Data shows that pet parents in western states spend more on their pets when compared to other parts of the US. This correlates with Google Trends data on customer interest and demand by region.

*(4,5)

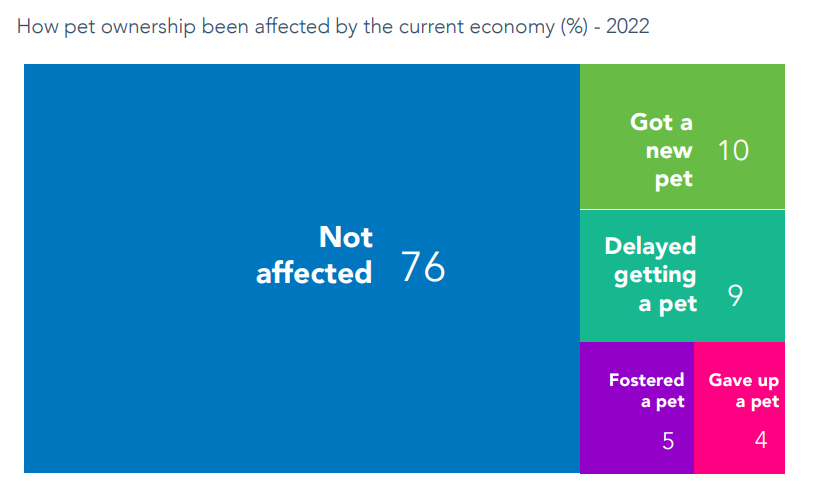

A survey by the APPA shows that 76% of pet owners claim that economic uncertainties have not affected their pet ownership

*(6)

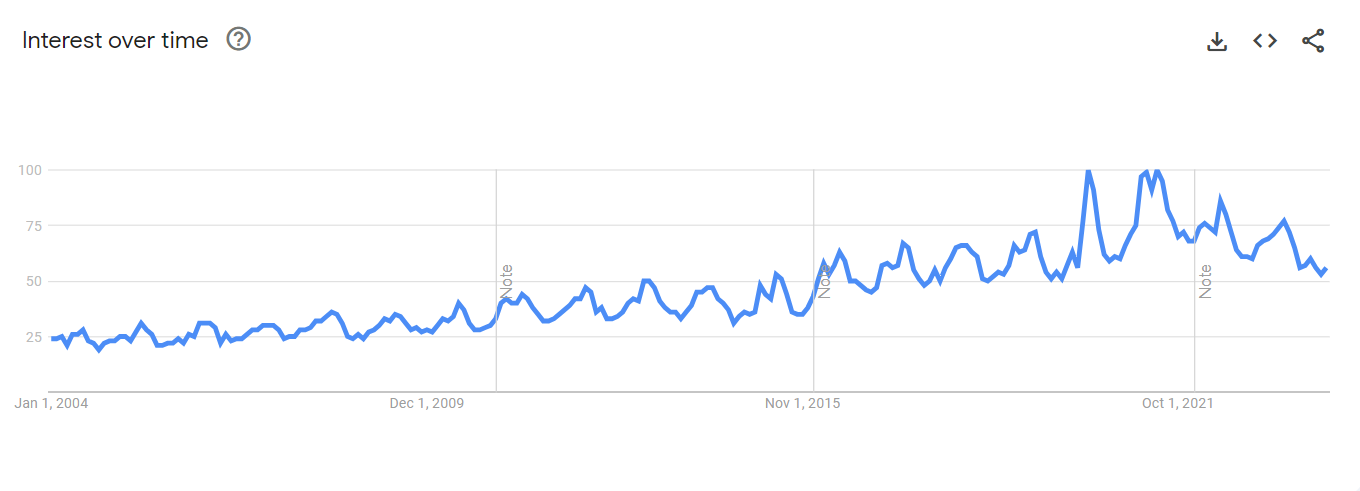

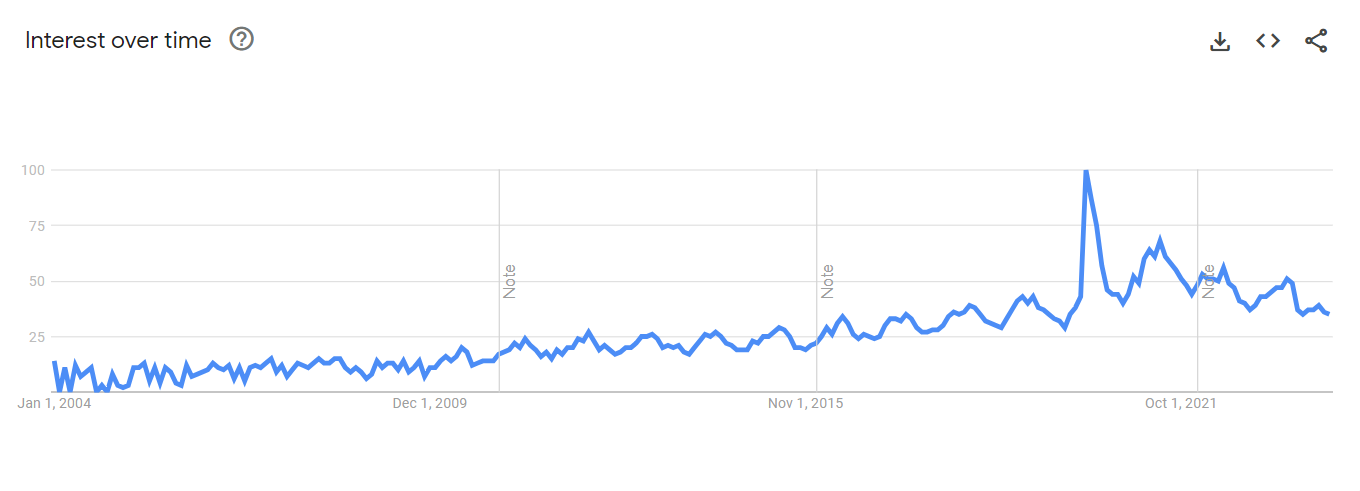

Customer demand/ searches over time

There is a clear spike in interest in dog grooming and mobile grooming services since the pandemic. Demand has remained higher than pre-pandemic levels since, suggesting this is still a great business to start.

Dog Grooming: Interest over time

*(7)

Mobile Dog Grooming: Interest over time

*(8)

Most popular areas ranked 1-52 (or whatever number is available)

Dog Grooming: Interest by state

Region

Dog grooming interest:

(10/24/18 - 10/24/23)

Rank (1- Most popular)

Nevada

Idaho

Washington

Utah

Oregon

Colorado

Michigan

New Mexico

Arizona

Oklahoma

Texas

Alaska

Wyoming

Indiana

Missouri

Illinois

Kansas

Montana

North Dakota

Minnesota

Wisconsin

Nebraska

North Carolina

South Dakota

Delaware

Ohio

New Jersey

Florida

California

Connecticut

Tennessee

Arkansas

Kentucky

Louisiana

Iowa

New Hampshire

Vermont

South Carolina

Massachusetts

Virginia

Pennsylvania

New York

Georgia

Rhode Island

Maryland

Maine

Alabama

West Virginia

Mississippi

District of Columbia

Hawaii

100

96

84

82

81

81

77

74

72

72

70

70

69

68

67

67

67

65

64

63

62

61

61

60

60

60

60

59

59

59

59

59

58

58

57

57

56

56

55

55

54

54

52

52

51

49

49

49

48

40

34

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

*(9)

Mobile Dog Grooming: Interest by state

Region

Dog grooming interest:

(10/24/18 - 10/24/23)

Rank (1- Most popular)

Nevada

Arizona

California

Colorado

Florida

Texas

Delaware

Idaho

Oregon

New Mexico

Rhode Island

Oklahoma

South Carolina

Connecticut

North Carolina

Tennessee

Maryland

Washington

Utah

Louisiana

Arkansas

Missouri

New Jersey

New Hampshire

Virginia

Nebraska

Indiana

Alabama

Ohio

Georgia

Kansas

Pennsylvania

Massachusetts

Kentucky

District of Columbia

New York

Michigan

West Virginia

Mississippi

Illinois

Iowa

Maine

Minnesota

Wisconsin

100

79

67

63

59

57

55

52

51

48

47

47

46

45

45

44

43

41

41

40

39

38

37

37

37

35

35

34

34

33

31

31

31

31

30

27

27

25

25

25

24

20

17

17

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

*(10)

Pet owners are continuing to prioritise pet health and well-being despite economic uncertainty, helping the continual growth and demand for dog and mobile grooming services across the US.

(1). Source: https://www.grandviewresearch.com/industry-analysis/pet-grooming-services-market

(2). Source: https://www.globenewswire.com/news-release/2023/10/11/2758614/0/en/The-Pet-Grooming-Services-Market-Size-demonstrates-a-6-3-CAGR-expected-to-create-animal-care-and-services-employment.html

(3). Source: https://www.gminsights.com/industry-analysis/mobile-pet-care-market

(4). Source: https://www.marketwatch.com/guides/pet-insurance/pet-spending-trends/

(5). Source: https://www.americanpetproducts.org/news/press-release/latest-pet-ownership-and-spending-data-from-appa-reveals-continued-strength-of-national-pet-industry-in-the-face-of-economic-uncertainty

(5). Source: https://www.americanpetproducts.org/docs/default-source/data-insights/appa2023stateofindustryreport.pdf

(6,7,8,9, 10). Source: Google Trends